Latest News

Edward Aparo

Jan 16, 2026

Edward Aparo

Edward Aparo

Edward Aparo passed away peacefully at his home on January 7, 2026 surrounded by his loving family.

Edward was born on May 10, 1936 in New Britain, CT. He was the beloved son of the late Anthony and Rose Valenti Aparo and attended New Britain schools. On April 7, 1958 Edward married his school sweetheart Jean Ackerman beginning a devoted marriage that spanned 67 years. Together they built a life rooted in family, hard work and love.

Edward began his career working in the family business, Aparo’s Electric Motor Service Inc. where he learned the trade alongside his father. Following his father’s passing, Edward became the owner of the business, carrying on the family legacy with dedication and pride. Edward is survived by his loving wife Jean Ackerman Aparo, his sons Stephen Aparo and his wife Marie of New Britain, CT and Craig Aparo and his wife Valerie of Naples, Fl, his sister Arlene Aparo StGermain and husband Joseph of Hobe Sound FL and his cherished grandchildren Danny Aparo and wife Nicole, Tyler Aparo and Morgan Wilson and Jared Aparo all of New Britain.

Services with be private.

Keep ReadingShow less

Henry Loher flew farther than any other competitor at Jumpfest 2025

Randy O'Rourke

SALISBURY — Salisbury’s longstanding tradition of ski jumping is reaching new heights this year with the 100th annual Jumpfest, scheduled for Feb. 6–8 at Satre Hill.

The weekend-long celebration begins with a community night on Friday, Feb. 6, followed by youth ski jumping competitions and the Salisbury Invitational on Saturday, and culminates Sunday with the Eastern U.S. Ski Jumping Championships.

While spectators look skyward to watch the high-flying athletes, Jumpfest will also invite the community to look back on Salisbury’s deep-rooted ski jumping history.

Ski jumping originated in Norway in the 19th century and is a tradition familiar to most Nordic children. That was the case for the five Satre brothers — John, Magnus, Ottar, Sverre and Olaf — who grew up competing in ski jumping and cross-country skiing.

When John Satre moved to Salisbury in 1923 to work as a chauffeur, he brought the tradition with him. The rolling hills and heavy winters of the Northwest Corner resembled those of Norway, allowing John to seamlessly integrate his passion into his new community.

Within a year, his brothers followed. In 1926, John Satre captivated roughly 200 spectators by skiing off a snow-covered barn roof.

The brothers soon formed the Salisbury Outing Club — now known as the Salisbury Winter Sports Association (SWSA) — and began construction of a permanent ski jump in the same location it sits today: Satre Hill.

By 1933, the Satre brothers had won numerous championships and helped popularize the sport across the United States. Salisbury hosted the U.S. Olympic Trials in 1932, and the following year hosted the National Championships.

Tragically in 1934, at the age of 40, John Satre was killed in a car accident. The New York Times hailed him as a pioneer in U.S. skiing and his legacy is carried on in the winter sports culture that is nurtured in Salisbury today.

During this time, local children were introduced to the sport, creating makeshift jumps in their backyards out of crates and hay bales. One of these children was Richard Parsons, who became the first Salisbury resident to earn recognition for cross country skills. He earned a spot for the 1932 Lake Placid Winter Olympic Games and in 1936 competed in the Winter Olympics in Garmisch, Germany, where he was the leading American-born cross-country skier.

During World War II, young athletes who would have normally been jumping were enlisted in the service, causing a lull in the sport and deterioration of the jump itself. After the war, however, community members eagerly worked to rebuild the jump, and another Salisbury athlete emerged.

Roy Sherwood was first introduced to ski jumping when his father built him and his brother their own ski jump in their backyard. Sherwood quickly gained ground, earning himself the title of “hometown hero.” By 1954, Sherwood was offered a spot on the U.S. Olympic Team for the 1956 games in Cortina, Italy.

Sherwood’s path to the Olympics was far from easy. A year before the Games, he was diagnosed with polio, threatening his ability to compete. He recovered enough to travel to Italy, only to hit an icy patch during a practice run.

Sherwood rebounded and competed the next day, placing 36th out of 51 — the second-highest finish by an American — and was later inducted into the U.S. Ski & Snowboard Hall of Fame.

Today, four jumps line Satre Hill — K10, K20, K30, and K65. The 65-meter jump is used for competitions, and the smaller jumps are used to teach local youth during winter camps.

Islay Sheil, a Housatonic Valley Regional High School student and Lakeville resident, is the current SWSA athlete on the rise in ski jumping today. Her passion for the sport emerged during one of the SWSA winter camps, and last March earned gold in the Junior National Championships. The next Junior National Championships will be hosted in Salisbury in 2027.

While Salisbury celebrates the 100th anniversary of its own ski jump this year, the Olympic Games will be held in Milan and Cortina, Italy, the same place that Sherwood gained global recognition.

To honor the town’s remarkable history and tradition of ski jumping, Jumpfest will begin early with a Winter Warmer on Jan. 31 between 5:30 to 8 p.m. It will be at the home of Salisbury First Selectman Curtis Rand. Small plates and drinks will be served. Limited tickets are available for $50 and more details can be found at Jumpfest.org/100years/

On Feb. 1, a double feature screening of On the Hill and Downhill Racer will be held at The Moviehouse in Millerton, followed by a panel discussion on winter sports and SWSA’s role in Salisbury’s history. There will also be a raffle and SWSA merchandise for sale.

Tickets for the showing are $16 and details can be found at Jumpfest.org/100years/.

On Friday, Feb. 6, Jumpfest will host community night at Satre Hill. SWSA will offer free admission for the night. Gates open at 6 p.m. and “Target Jumping Under the Lights” will begin at 7 p.m. There will be fireworks sponsored by NBT Bank, bonfires, and food and drinks available for purchase. The Human Dogsled Race is set for 8:30 p.m. Teams of five can register at Jumpfest.org

On Saturday, Feb. 7, the Junior Competition on K20 jump will begin at 9 a.m. The Salisbury Invitational Ski Jumping Competition will practice from 11 a.m. to noon and compete at 1 p.m. Community members are invited to the Snow Ball at the Lakeville Town Grove at 8 p.m. Dancers will be accompanied by live music from the Steve Dunn Band. Entrance to the Ball is $20 with children 12 and under free of charge.

On Sunday, Feb 8, Satre Hill will hold the Eastern U.S. Ski Jumping Championships. Athletes will practice between 11 a.m. to noon and compete at 1 p.m.

When describing the community that surrounds the ski jumps, Willie Hallihan of SWSA explained that the length of time and number of people involved on an emotional level has made the sport “iconic to Salisbury.”

Hallihan recounted in the PBS documentary “The Jump” that the ski jumps are “like a family member to a lot of people”.

Keep ReadingShow less

Richard Charles Paddock

Jan 14, 2026

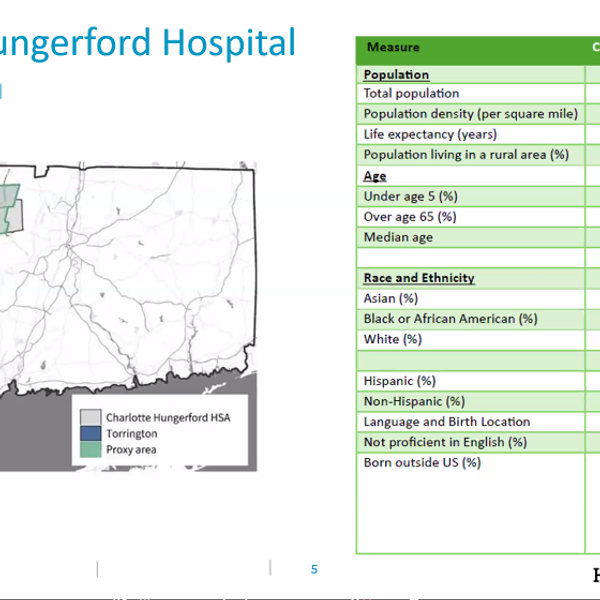

TACONIC — Richard Charles Paddock, 78, passed away Friday, Jan. 2, 2026, at Charlotte Hungerford Hospital.

He was born in Hartford on April 12, 1947 to the late Elizabeth M. Paddock (Trust) and the late Charles D. Paddock. He grew up in East Hartford but maintained a strong connection to the Taconic part of Salisbury where his paternal grandfather, Charlie Paddock, worked for Herbert and Orleana Scoville. The whole family enjoyed summers and weekends on a plot of land in Taconic gifted to Charlie by the Scovilles for his many years of service as a chauffeur.

Dick graduated from East Hartford High School in June of 1965 and went on to join the Class of 1969 at the Massachusetts Institute of Technology. He graduated from MIT with a degree in Electrical Engineering and followed in his father’s footsteps by accepting a job with IBM in 1969. His career at IBM spanned 31 years and involved everything from supercomputers to single chip microcomputers.

He formally retired from IBM in 2000 but stayed on at IBM as a contract employee for the IBM Executive Briefing Center in Poughkeepsie, New York. His work at the briefing center ended in July 2002 and he finally had time to pursue other interests. Those interests included the iron industry of the Northwest Corner and the Central New England Railroad which passed through Taconic from 1871 until 1965.

Dick joined the Friends of Beckley Furnace in 2003 where he helped develop educational programs with the late Ed Kirby and designed and produced interpretive signs to explain the site to visitors, spending most summer Saturdays as a docent at the site. He also joined the Historical Society branch of the Salisbury Association where he assisted in the preparation of numerous books, the oral history and interpretive signs for the Salisbury area. He also served several terms as a Trustee for the Association. Other activities included teaching courses for the Taconic Learning Center and The Bard Lifetime Learning Center and being a frequent speaker in the area on various topics such as the railroads, the iron industry and the industrial heritage of the area.

He leaves behind his wife and best friend, Frances Paddock of Taconic, two stepchildren; David Rosell of Greenville, New York, his son, Sterling of Tivoli, New York; Alicia Rosell of Dalton, Georgia, her daughters, Mary Rosell and Paula Gordon, also of Dalton, and his very large family of in-laws and many friends.

There will be no funeral services at this time. Ryan Funeral Home, 255 Main St., Lakeville, is in care of arrangements.

If you would like to remember Dick, please contribute to Friends of Beckley Furnace, P.O. Box 383, East Canaan, CT 06024, or the Salisbury Association (https://salisburyassociation.org/ways-to-support/donate/)

To offer an online condolence, please visit ryanfhct.com

Keep ReadingShow less

In Appreciation: Richard Paddock

Jan 14, 2026

SALISBURY — Richard Paddock, a longtime Salisbury resident whose deep curiosity and generosity of spirit helped preserve and share the town’s history, died last week. He was 78.

Paddock was widely known as a gifted storyteller and local historian, equally comfortable leading bus tours, researching railroads or patiently helping others navigate new technology. His passion for learning — and for passing that knowledge along — made him a central figure in the Salisbury Association’s Historical Society and other preservation efforts throughout the Northwest Corner.

“He was an incredible storyteller,” said Salisbury Association Executive Assistant and Historian Lou Bucceri, who co-chaired the association’s historical society with Paddock. He remembered the bus tour of Twin Lakes that Paddock led that was so popular a second one had to be scheduled. He also was instrumental, along with Bill Morrill, in obtaining a Revolutionary War cannon for the association.

The Twin Lakes neighborhood was central to Paddock’s life, where he spent summers as a young boy. His family’s ties to the area stretched back generations. His grandfather, Charles Paddock, lost his wife and three of his four children during the influenza epidemic of 1917, leaving him to raise an 8-year-old son — Paddock’s father.

Charles Paddock later found work as a chauffeur for the family of Herbert Scoville Jr., who maintained a mansion in Taconic. Scoville, a trained scientist, spent years working for the CIA before serving with the Arms Control and Disarmament Agency, and became a tireless advocate for nuclear disarmament in the latter part of his life.

In a 2016 interview with Jean McMillen, who recorded more than 400 oral histories of Salisbury residents, Paddock reflected on the Scoville family’s generosity, noting that several longtime employees — including his grandfather — were granted an acre of land after 25 years of service.

“You hear a lot of stories about brutality between the householder and the employees. That is just not the way it was here with the Scoville family. I have done some research. I know several of the current generation of the Scoville family. I got interested in the family and they played a big role in my grandfather’s life and my father’s life and certainly I live now on that piece of land that they gave my grandfather, so they steered my life as well,” Paddock said.

Peter Wick, a longtime friend of Paddock, said their relationship began when they were both young boys — Paddock visiting his grandfather in Twin Lakes and Wick visiting his own family in the area. Both of their grandfathers worked for wealthy residents in Taconic.

Wick, now of Granby, called his friend “an inspiration. He was definitely one of my best friends. I think I need to ask Dick something and then realize he’s not there. He was so smart, especially when it came to technology.”

Paddock’s family lived winters in East Hartford and he graduated from the Massachusetts Institute of Technology with a degree in electrical engineering. He spent his career at IBM, where he developed a deep interest in computers and became highly proficient in the field.

McMillen, who became close with Paddock and his wife, Fran, said he was so very helpful in teaching her how to use computers for her oral histories.

“He was so knowledgeable and gifted; he never made me feel dumb. He always showed kindness and generosity.” McMillen said.

She added that Paddock had wide-ranging interests, including history and railroads.

Paddock’s passion for history led him to become active in the Salisbury Association’s Historical Society, and, later, the Friends of Beckley Furnace. The East Canaan furnace produced iron ore back in the 1800s, bringing a flourishing industry to the Northwest Corner. In his oral history, Paddock explained the members decided to help the state make some use of the furnace, which it had purchased in 1945. Spearheaded by the late Ed Kirby and Fred Hall, the committee was able to get some money to stabilize the structure.

“They wanted to turn it into a real asset in the park system,” he told McMillan. “Times have not changed much; the state of Connecticut had the inclination but not the resources to really operate that. We formed a non-profit and a bunch of us old gray-haired guys take care of that site.”

For many years, Paddock and several others spent Saturday mornings at the site, interpreting its history for visitors and often surprising them by explaining that railroad car wheels were made from iron produced at the furnace.

“Think about the time frame between 1830 and 1900,” he said in the oral history. “Westward expansion is being carried out on top of wheels made in Connecticut. Certainly not exclusively, but the best wheels that went the farthest were made here in northwest Connecticut. This silly little town had a lot of impact on the development of the country.”

Christian Allyn joined the group as a young docent, working alongside the older volunteers on those Saturday mornings. He recalls many fond memories from that time, including a surprise visit from former First Lady Laura Bush in 2014 and selling iron ingot paperweights to visitors.

Allyn said he learned a great deal from the men “who would dive deep into both the business and personality sides of the iron industry. Those lessons were foundational in establishing my life in the Northwest hills.”

Railroads were another of Paddock’s passions. He was particularly interested in the long-gone Central New England line since, as a child, he discovered tracks that crossed a causeway at Twin Lakes. As he did with every subject of interest, he did extensive research on local trains and would present programs on the topic.

Bucceri echoed the sentiments of many: “If you didn’t know Dick, I’m sorry. I miss him so much.”

— Ruth Epstein

Keep ReadingShow less

loading