Latest News

CVFD reaches fundraising goal for new fire trucks

Provided

CORNWALL — At the recommendation of the Cornwall Volunteer Fire Department, on Jan. 20 the Board of Selectmen voted to move forward with the purchase of two new trucks.

Greenwood Emergency Vehicles, located in North Attleboro, Massachusetts, was chosen as the manufacturer. Of the three bids received, Greenwood was the lowest bidder on the desired mini pumper and a rescue pumper.

CVFD’s Ian Ridgway sat on the truck committee and said Greenwood was not just chosen for the price, but also for the design of each vehicle. He said their models had a shorter wheelbase and more ground clearance, as well as extra storage space on board, compared to the next best bid.

After $100,000 in discounts offered by Greenwood, the combined purchase price for both vehicles was shown to be $1,200,408. The delivery time was estimated at 15 months.

CVFD raised $600,000 during its recent fundraising campaign, of which $500,000 will be given to the town to buy the trucks. That figure will be paired with $720,000 in town truck fund reserves. The additional donated funds will be used to outfit the trucks with equipment and tools.

“I want to praise the town of Cornwall,” said CVFD President Dick Sears. “We’re able to buy these beautiful new pieces of equipment courtesy of the tremendous citizenry of this town.”

Keep ReadingShow less

Robin Lee Roy

Jan 21, 2026

FALLS VILLAGE — Robin Lee Roy, 62, of Zephyrhills, Florida, passed away Jan. 14, 2026.

She was a longtime CNA, serving others with compassion for more than 20 years before retiring from Heartland in Florida.

Robin loved the beach, sunshine, and gardening, and was known for her strength, humor, and unwavering support of those she loved.

She is survived by her daughter, Sierra R. Zinke, and brothers, Darren Roy and Todd Roy.

She was preceded in death by her parents, Sharon Thomkins Roy and Robert Roy, and her brother Nevin Roy.

No services will be held at this time.

Keep ReadingShow less

Marjorie A. Vreeland

Jan 21, 2026

SALISBURY — Marjorie A. Vreeland, 98, passed away peacefully at Noble Horizons, on Jan. 10, 2026.She was surrounded by her two loving children, Richard and Nancy.She was born in Bronxville, New York,on Aug. 9, 1927, to Alice (Meyer) and Joseph Casey, both of whom were deceased by the time she was 14. She attended public schools in the area and graduated from Eastchester High School in Tuckahoe and, in 1946 she graduated from The Wood School of Business in New York City.

At 19 years old, she married Everett W. Vreeland of White Plains, New York and for a few years they lived in Ithaca, New York, where Everett was studying to become a veterinarian at Cornell. After a short stint in Coos Bay, Oregon (Mike couldn’t stand the cloudy, rainy weather!) they moved back east to Middletown, Connecticut for three years where Dr. Vreeland worked for Dr. Pieper’s veterinary practice.In Aug. of 1955, Dr. and Mrs. Vreeland moved to North Kent, Connecticut with their children and started Dr. Vreeland’s Veterinary practice. In Sept. of 1968 Marjorie, or “Mike” as she wished to be called, took a “part-time job” at the South Kent School.She retired from South Kent 23 years later on Sept. 1, 1991.Aside from office help and bookkeeping she was secretary to the Headmaster and also taught Public Speaking and Typing.In other times she worked as an assistant to the Town Clerk in Kent, an office worker and receptionist at Ewald Instruments Corp. and as a volunteer at the Kent Library.

“Mike” loved the sun, sand and water and spent many summers at Westport Point, Massachusetts with the kids and their best friends, the Bauers.She was the consummate hostess, and a wonderful cook.She also appeared in several plays with The Sherman Players and also a show or two on special occasions at The Kent Community House.She took enjoyment from working outdoors doing chores around her home in North Kent.She lived in that house until she sold it and bought a condominium on North Main Street in Kent in May of 2003.She lived in the condo until 2018 after which her light began to fade and her last 8 years were spent comfortably at Noble Horizons.

“Mike” leaves behind her children, Richard (Susan) of Lakeville, her daughter Nancy Rutledge (Jim) of Salisbury; two grandchildren, Chandra Gerrard (Sean) of Litchfield, Matthew (Larissa) of Lakeville; three great grandchildren, Addison, Emilia and Everett, all of Lakeville.

She was predeceased by her beloved granddaughter Caroline in 2020.

All services are private.The Ryan Funeral Home, 255 Main St., Lakeville, is in charge of arrangements.

To offer an online condolence, please visit ryanfhct.com

Keep ReadingShow less

Rafael A. Porro

Jan 21, 2026

SALISBURY -— Rafael A. Porro, 88, of 4 Undermountain Road, passed away Jan. 6, 2026, at Sharon Hospital. Rafael was born on April 19, 1937 in Camaguey, Cuba the son of Jose Rafael Porro and Clemencia Molina de Porro. He graduated from the Englewood School for Boys in Englewood, New Jersey and attended Columbia University School of General Studies. Rafael retired as a law library clerk from the law firm of Curtis, Mallet Prevost in 2002 and came to live in Salisbury to be nearer to his sister, Chany Wells.

Rafael is survived by his sister, Chany Wells, his nephew Conrad Wells (Gillian), and by numerous cousins in North Carolina, Florida, Wyoming, Arizona, Cuba and Canada. He was the eldest of the cousins and acknowledged family historian. He will be greatly missed.

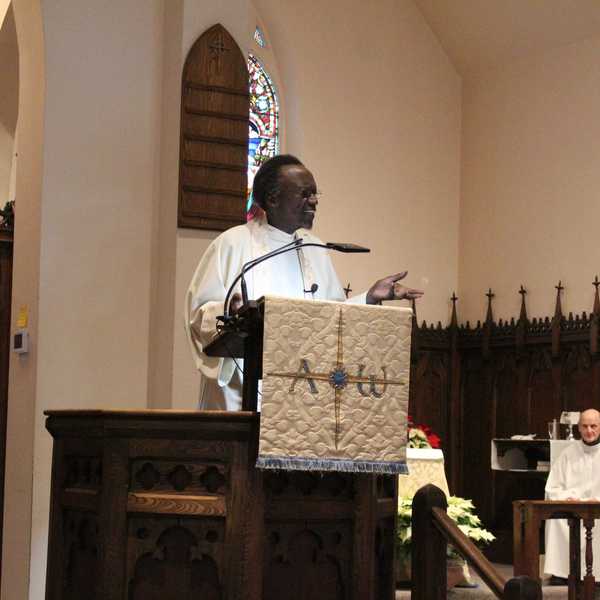

A memorial service will be held at St. John’s Episcopal Church in June. Memorial contributions may be made to Salisbury Volunteer Ambulance Service, St. John’s Episcopal Church in Salisbury and Scoville Memorial Library.

The Kenny Funeral Home has care of arrangements.

Keep ReadingShow less

loading