Latest News

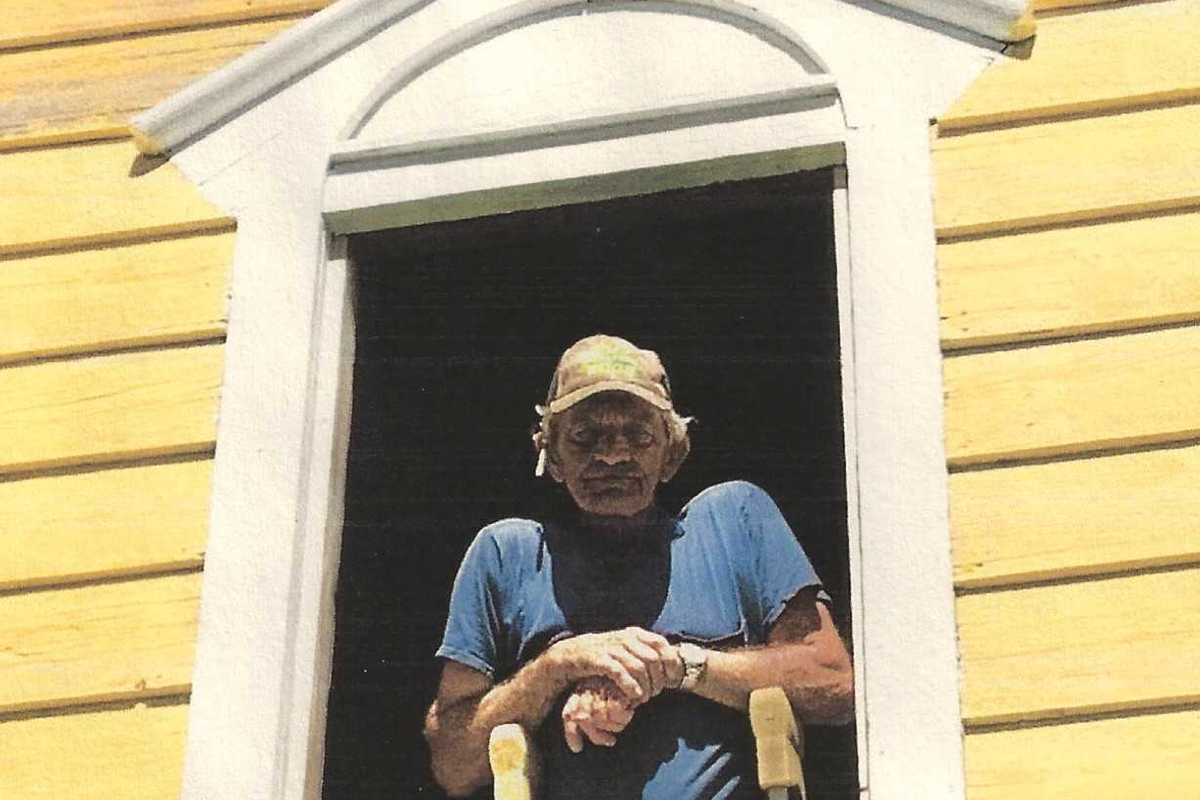

James Cookingham

Jan 28, 2026

MILLERTON — James (Jimmy) Cookingham, 51, a lifelong local resident, passed away on Jan. 19, 2026.

James was born on April 17, 1972 in Sharon, the son of Robert Cookingham and the late Joanne Cookingham.

He attended Webutuck Central School.

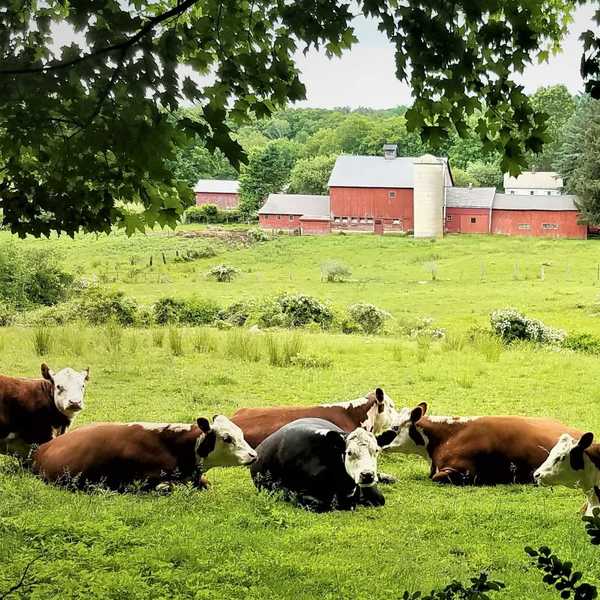

Jimmy was an avid farmer since a very young age at Daisey Hill and eventually had joint ownership of Daisey Hill Farm in Millerton with his wife Jessica.

He took great pride in growing pumpkins and sweet corn.

He was very outdoorsy and besides farming, loved to ride four wheelers, fish, and deer hunt. He also loved to make a roaring bonfire.

He was a farmer, friend, husband, father, son and brother. He will be missed by many.

He is survived by his father, Robert Cookingham, wife Jessica (Ball) Cookingham, daughters, Hailey Cookingham-Loiodice (Matt), Taylor Ellis-Tanner (Jimmy) and sister Brenda Valyou, as well as many cousins, nieces and nephews.

He is predeceased by his mother, Joanne (Palmer) Cookingham.

His daughter, Hailey, will always keep his legacy alive by their father-daughter antics, such as their handshake, nicknames and making “quacking noises” at each other.

Services/Memorials will be held at a later date.

The Kenny Funeral Home has care of arrangements.

Keep ReadingShow less

Herbert Raymond Franson

Jan 28, 2026

SALISBURY — Herbert Raymond Franson, 94, passed away on Jan. 18, 2026. He was the loving husband of Evelyn Hansen Franson. Better known as Ray, within his family, and Herb elsewhere.

He was born on Feb. 11, 1931 in Brooklyn, New York.

When he was three years old, he emigrated to Sweden with his mother, Amy (Larson), father Carl Herbert and sister, Ruth. He was nurtured by members of his extended family. Being owners and managers of manufacturing plants in rural Sweden, they gave this curious “nuts and bolts kind of guy” access to machinery where he could satisfy his needs to repair and build parts for his kid-style projects. At 18 he returned to relatives in Marlborough, Connecticut who encouraged him to continue high school. He met classmate Evelyn, his English tutor and future wife, at East Hampton High School and they graduated in the class of 1949.

He joined the US Navy and served in the Mediterranean aboard the USS Midway and, during the Korean conflict, aboard the USS Pine Island. Upon discharge he attended Porter School of Machine and Tool Design under the GI Bill. He then apprenticed as a tool and die maker for Pratt Whitney Aircraft, then worked for Stirling Engineering, culminating as a mold engineer with Becton Dickinson, Canaan, Connecticut; much closer to his home on Twin Lakes. At B-D he was involved in molding technology and traveled to plants worldwide overseeing production of syringes used to deliver vaccines.

Along the way, he renovated and constructed three homes in Marlborough and Salisbury and in Rangeley, Maine.

Ray and Evelyn retired to Rangeley in 1992 after living at Twin Lakes for 25 years. He joined the Rangeley Congregational Church just in time to coordinate renovation of the church’s old barn into a community center. This led to the position of “clerk of the works” when the Rangeley Region Guides and Sportsmen’s Association renovated and enlarged their clubhouse in Oquossoc. RRG&SA honored his dedication with a Lifetime Membership. He also volunteered driving the RRHAT van and coordinated meal deliveries for the Housing Development. He served on various boards of the church chairing buildings and grounds for many years. In his eighties, Ray turned to designing and building scratch built wood models including the Drottningholm (on which he had emigrated), the USS Midway and the steamship Rangeley to mention a few.

Ray leaves his wife of 72 years, Evelyn (Hansen), his sister, Astrid F. Harrison of Cromwell, Connecticut, brother, Carl B. Franson of Lime Rock, son Kenneth and wife Christine of Wolfeboro, New Hampshire and Rangeley, Maine, daughter, Jean F. Bell and husband Rick of Salisbury. Grandchildren Kayla J. (Bell) Johnson and husband Brett of Salisbury, and Cody J. Franson, wife Maria and great granddaughter Francesca Evelyn Franson of Rangeley, Maine.

In lieu of flowers, monetary remembrances may be made to the Rangeley Congregational Church, PO Box 218, Rangeley, ME, 04970.

The Kenny Funeral Home has care of arrangements.

Keep ReadingShow less

Moses A. Maillet, Sr.

Jan 28, 2026

AMENIA — Moses A. “Tony” Maillet, Sr., 78, a longtime resident of Amenia, New York, passed away on Monday, Jan. 19, 2026, at Vassar Brothers Medical Center in Poughkeepsie, New York. Tony owned and operated T & M Lawn and Landscaping in Amenia.

Born on March 9, 1947, in St. Alphonse de Clare, Nova Scotia, he was the son of the late Leonard and Cora (Poirier) Maillet. Tony proudly served in the US Army during Vietnam as a heavy equipment operator. On May 12, 1996, in Amenia, he married Mary C. Carberry who survives at home.

Tony was a life member of the Amenia Fire Company with 51 years of dedicated service, actively driving fire trucks until his illness in Nov. of 2025. He was charter member of the Red Knights Motorcycle Club NY Chapter 33 in Pleasant Valley, New York and a member of the American Legion Post # 178 in Millerton, New York.

In addition to his loving wife, Tony is survived by a son, Moses A. Maillet, Jr. of Waterbury, Connecticut, and two brothers, Mark Maillet of New Port Richie, Florida and Bernard Ross of Cambridge, Ontario. He is also survived by two grandchildren, Moses A. Maillet, III and Jacob Maillet; a great-granddaughter, Mary Lillian Maillet and several nieces and nephews. Besides his parents, Tony was predeceased by three brothers, Theodore Poirier, Donald Maillet and Edward Maillet.

A memorial Mass will be celebrated at 11 a.m. on Saturday, Jan. 31, 2026, at Immaculate Conception Church, 4 Lavelle Rd., Amenia, New York with Rev. Andrew O’Connor officiating. Military honors and firematic services will follow the memorial mass at the church. Memorial contributions may be made to the Amenia Fire Company, 36 Mechanic Street, Amenia, NY 12501. For directions or to send the family a condolence, please visit www.hufcutfuneralhome.com

Keep ReadingShow less

loading

Telecom Reg’s Best Kept On the Books

When Connecticut land-use commissions update their regulations, it seems like a no-brainer to jettison old telecommunications regulations adopted decades ago during a short-lived period when municipalities had authority to regulate second generation (2G) transmissions prior to the Connecticut Siting Council (CSC) being ordered by a state court in 2000 to regulate all cell tower infrastructure as “functionally equivalent” services.

It is far better to update those regs instead, especially for macro-towers given new technologies like small cells. Even though only ‘advisory’ to the CSC, the preferences of towns by law must be taken into consideration in CSC decision making. Detailed telecom regs – not just a general wish list -- are evidence that a town has put considerable thought into where they prefer such infrastructure be sited without prohibiting service that many – though not all – citizens want and that first responders rely on for public safety.

Such regs come in handy when egregious tower sites are proposed in sensitive areas, typically on private land. The regs are a town’s first line of defense, especially when cross referenced to plans of conservation and development, P&Z regulations, and wetlands setbacks. They identify how/where the town plans to intersect with the CSC process. They are also a roadmap for service providers regarding preferred sites and sometimes less neighborhood contention. In fact, to have no telecom regs can weaken a town’s rights to protect environmental, scenic, and historic assets, and serve up whole neighborhoods to unnecessary overlapping coverage and corporate overreach. Such regs are unique to every town and should not follow anyone else’s boiler plate, especially industry’s.

Connecticut is the only state that has a centralized siting entity for cell towers. The good news is that applicants must prove need for new tower sites in an evidentiary proceeding and any decisions have the weight of the state behind them. The bad news is that the CSC used to be far less industry-friendly and rote in their reviews, which now resemble a check list. There is an operative assumption at CSC that if an applicant wants a tower, they must need it, otherwise why spend significant money to run the approval gauntlet? This reflects a subtle shift over the years at CSC from sincere willingness to protect the environment toward minimal tweaking of bad applications with minor changes. The bottom line is that towns really cannot rely on the CSC to do all the work for them.

What CSC issues telecom providers is a “certificate of environmental compatibility” after an evidentiary proceeding (not unlike a court case) with intervenors, parties, expert witnesses, and the service provider’s technical pro’s sworn in and subject to cross examination. Service providers get to do the same with any opposition from intervenor/party participants – like towns and citizens -- and their experts. It’s an impressive process whose ultimate goal is the fine balancing between allowing adequate/reliable public services and protecting state ecology with minimal damage to scenic, historic, and recreational values. They unfortunately often fall short of their mandate – like approving cell towers with diesel generators over town aquifers -- evidenced by CSC only rejecting about five cell towers in the past 15-20 years.

The CSC was founded in 1972 and clarified its mission in the 1980’s to prevent the state from being carved up willy-nilly by gas pipelines, high tension corridors, and broadcast towers. With the sudden proliferation of cell towers beginning in late 1990’s, it became the most sued agency in Connecticut by both an arrogant upstart industry if applications were denied and by towns/citizens when bad sites were forced on them. CSC gradually formed a defensive posture that drives their decisions toward industry with deeper pockets and attorneys on retainer.

For citizens, nothing can wreck one’s day like the CSC. It behooves towns to protect what little toolkit they have, and understand the legal parameters of the CSC’s playing field. The CSC is not a “normal” government agency where municipal/citizen redress is based on logic and local support. Their process is largely immune to everything but specific kinds of evidence – like town regs with setbacks/fall zones, radio frequency transmission signal strengths, sensitive areas identified, and detailed wildlife inventory, among others.

There is a current cell tower fight involving two intervening towns -- Washington and Warren; both with good cell tower regs – over a tower site within 1200’ of a Montessori School, near Steep Rock’s nature preserves with comprehensive geology/wildlife databases that include endangered, threatened and special concern flora and fauna, on established federal/state migratory bird flyways, within throwing distance to a historic site capable of being listed on the Underground Railroad, and with an access road on a blind curve entering a state highway that will permanently damage wetlands, vernal pools, and core forests. There are well credentialed environmental experts, including Dr. Michael Klemens, former chair of Salisbury’s P&Z, as well as the former director of migratory bird management at the US Fish and Wildlife Service, and an RF engineer testifying to alternative approaches, plus three attorneys representing intervenors. It is the most professional challenge I have seen at CSC since Falls Village successfully mounted one that protected Robbins Swamps several years ago.

The hearing is ongoing, with uncertain results. To see what it takes today to stop an inappropriate tower siting, see Docket #543 under “Pending Matters” at https://portal.ct.gov/csc before removing local cell tower regs – the lowest hanging fruit that any town can possess in case it’s needed.

B, Blake Levitt is the Communications Director at The Berkshire-Litchfield Environmental Council. She writes about how technology affects biology.