Latest News

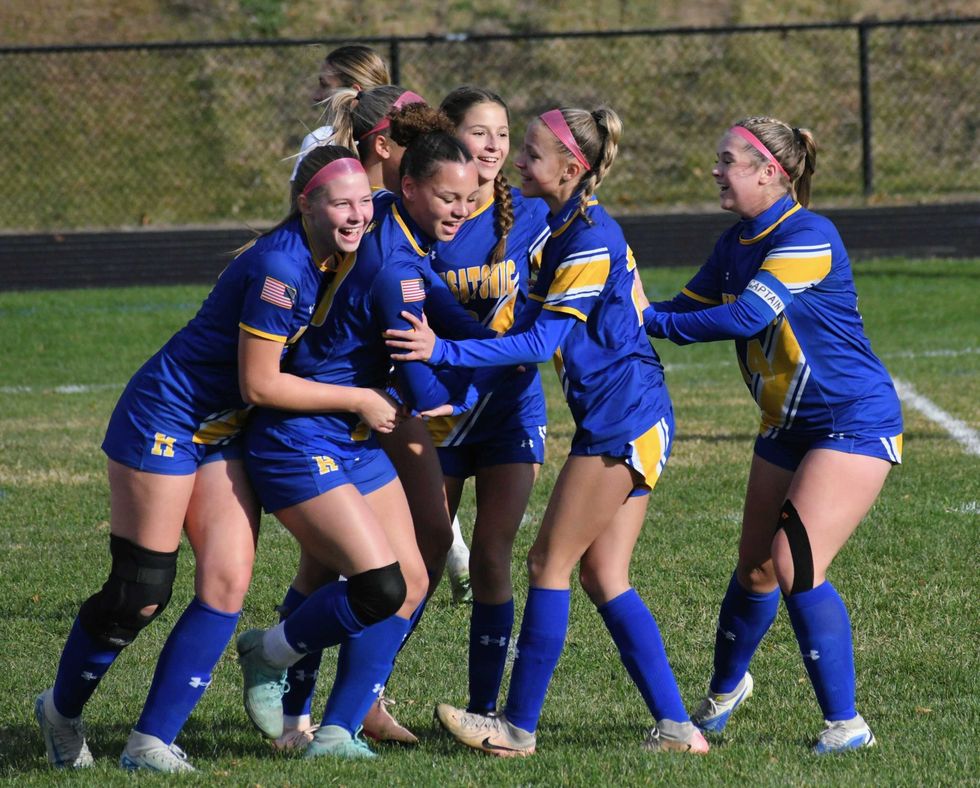

Ava Segalla, Housatonic Valley Regional High School's all-time leading goal scorer, has takes a shot against Coventry in the Class S girls soccer tournament quarterfinal game Friday, Nov. 7.

Photo by Riley Klein

FALLS VILLAGE — Housatonic Valley Regional High School’s girls soccer team is headed to the semifinals of the state tournament.

The Mountaineers are the highest seeded team of the four schools remaining in the Connecticut Interscholastic Athletic Conference Class S playoff bracket.

HVRHS (3) will play Morgan High School (10) in the semifinals. On the other side of the bracket, Canton High School (4) will play Old Saybrook High School (9). The winners of both games will meet in the Class S championship game.

To start the tournament, HVRHS earned a first-round bye and then had home-field advantage for the second-round and quarterfinal games.

In the second round Tuesday, Nov. 4, HVRHS won 4-3 against Stafford High School (19) in overtime. Ava Segalla scored three goals for Housatonic, including the overtime winner, and Lyla Diorio scored once. Bella Coporale scored twice for Stafford and Gabrielle Fuller scored once.

HVRHS matched up against Coventry High School (11) in the quarterfinal round Friday, Nov. 7. In the 2024 tournament, Coventry eliminated the Mountaineers in the second round.

Revenge was served in 2025 with a 4-2 win for HVRHS. Segalla scored her second hat trick of the tournament and Georgie Clayton scored once. Coventry’s goals came from Jianna Foran and Savannah Blood.

“The vibes are great,” said HVRHS Principal Ian Strever at the quarterfinal game.

The semifinal against Morgan will be played Wednesday, Nov. 12, on neutral ground at Newtown High School.

If HVRHS wins, it will mark the girls soccer team’s first appearance in the Class S title game since 2014.

Morgan was the runner-up in last year’s Class S girls soccer tournament, losing in penalty kicks to Coginchaug High School.

Keep ReadingShow less

Legal Notices - November 6, 2025

Nov 05, 2025

Legal Notice

The Planning & Zoning Commission of the Town of Salisbury will hold a Public Hearing on Special Permit Application #2025-0303 by owner Camp Sloane YMCA Inc to construct a detached apartment on a single family residential lot at 162 Indian Mountain Road, Lakeville, Map 06, Lot 01 per Section 208 of the Salisbury Zoning Regulations. The hearing will be held on Monday, November 17, 2025 at 5:45 PM. There is no physical location for this meeting. This meeting will be held virtually via Zoom where interested persons can listen to & speak on the matter. The application, agenda and meeting instructions will be listed at www.salisburyct.us/agendas/. The application materials will be listed at www.salisburyct.us/planning-zoning-meeting-documents/. Written comments may be submitted to the Land Use Office, Salisbury Town Hall, 27 Main Street, P.O. Box 548, Salisbury, CT or via email to landuse@salisburyct.us. Paper copies of the agenda, meeting instructions, and application materials may be reviewed Monday through Thursday between the hours of 8:00 AM and 3:30 PM at the Land Use Office, Salisbury Town Hall, 27 Main Street, Salisbury CT.

Salisbury Planning & Zoning Commission

Martin Whalen, Secretary

11-06-25

11-13-25

Notice of Decision

Town of Salisbury

Planning & Zoning Commission

Notice is hereby given that the following action was taken by the Planning & Zoning Commission of the Town of Salisbury, Connecticut on October 20, 2025:

8-24 referral was deemed consistent with the Plan of Conservation and Development - For the use of town-owned land at 20 Salmon Kill Road, Salisbury for housing, recreation, and conservation. The property is shown on Salisbury Assessor’s Map 11 as Lot 26.

Any aggrieved person may appeal these decisions to the Connecticut Superior Court in accordance with the provisions of Connecticut General Statutes §8-8.

Town of Salisbury

Planning &

Zoning Commission

Martin Whalen, Secretary

11-06-25

Notice of Decision

Town of Salisbury

Inland Wetlands & Watercourses Commission

Notice is hereby given that the following actions were taken by the Inland Wetlands & Watercourses Commission of the Town of Salisbury, Connecticut on October 27, 2025:

Exempt - Application IWWC-25-75 by Elaine Watson to install a 4’ by 45’ removable dock adjacent to the high-water mark of Lake Wononscopomuc. The property is shown on Salisbury Assessor’s map 47 lot 11 and is a vacant parcel located between 123 & 137 Sharon Road, across from and associated with 126 Sharon Road. The owners of the property are Paul and Elaine Watson.

Approved with the condition that any additional permits required for this project are filed with the Land Use Office - Application IWWC-25-74 by Richard Riegel, Principal of Lime Rock Park II, LLC to reinforce compromised river bank and implement riparian restoration in partnership with Trout Unlimited. The property is shown on Salisbury Assessor’s map 04 lot 16 and is known as 497 Lime Rock Road, Lakeville. The owner of the property is Lime Rock Park II, LLC.

Approved - Application IWWC-25-72 by George Johannesen of Allied Engineering Associates, Inc. for an addition to the existing house, construct garage, relocate driveway, landscaping. The property is shown on Salisbury Assessor’s map 08 lot 03 and is known as 396 Salmon Kill Road, Lakeville. The owners of the property are Randall Allen and Margaret Holden.

Approved subject to conditions recommended by the Town Consulting Engineer and the relinquishment of permit 2024-IW-036 - Application IWWC-25-69 by Bob Stair to construct an addition to the existing house and driveway in the upland review area. The property is shown on Salisbury Assessor’s map 67 lot 07 and is known as 300 Between the Lakes Road, Salisbury. The owner of the property is 280 BTLR LLC.

Approved subject to conditions recommended by the Town Consulting Engineer - Application IWWC-25-73 by Hotchkiss School (Michael J. Virzi) for a restoration plan for the existing temporary dining building at the Hotchkiss School. The property is shown on Salisbury Assessor’s map 06 lot 09 and is known as 22 Lime Rock Road, Lakeville. The owner of the property is Hotchkiss School.

Any aggrieved person may appeal this decision to the Connecticut Superior Court in accordance with the provisions of Connecticut General Statutes §22a-43(a) & §8-8.

11-06-25

NOTICE TO CREDITORS

ESTATE OF

DEBRA ANN WHITBECK

Late of North Canaan

(25-00419)

The Hon. Jordan M. Richards, Judge of the Court of Probate, District of Litchfield Hills Probate Court, by decree dated October 16, 2025, ordered that all claims must be presented to the fiduciary at the address below. Failure to promptly present any such claim may result in the loss of rights to recover on such claim.

The fiduciary is:

Donna L. Cooke

65 Orchard Street

North Canaan, CT 06018

Megan M. Foley

Clerk

11-06-25

NOTICE TO CREDITORS

ESTATE OF

THOMAS CROSBY DOANE

Late of North Canaan

(25-00388)

The Hon. Jordan M. Richards, Judge of the Court of Probate, District of Litchfield Hills Probate Court, by decree dated October 9, 2025, ordered that all claims must be presented to the fiduciary at the address below. Failure to promptly present any such claim may result in the loss of rights to recover on such claim.

The fiduciary is:

Jase Doane

5 Clearwater Lane

East Hampton, CT 06424

Megan M. Foley

Clerk

11-06-25

Keep ReadingShow less

Classifieds - November 6, 2025

Nov 05, 2025

Help Wanted

Weatogue Stables has an opening: for a full time team member. Experienced and reliable please! Must be available weekends. Housing a possibility for the right candidate. Contact Bobbi at 860-307-8531.

Services Offered

Deluxe Professional Housecleaning: Experience the peace of a flawlessly maintained home. For premium, detail-oriented cleaning, call Dilma Kaufman at 860-491-4622. Excellent references. Discreet, meticulous, trustworthy, and reliable. 20 years of experience cleaning high-end homes.

Hector Pacay Service: House Remodeling, Landscaping, Lawn mowing, Garden mulch, Painting, Gutters, Pruning, Stump Grinding, Chipping, Tree work, Brush removal, Fence, Patio, Carpenter/decks, Masonry. Spring and Fall Cleanup. Commercial & Residential. Fully insured. 845-636-3212.

SNOW PLOWING: Be Ready! Local. Sharon/Millerton/Lakeville area. Call 518-567-8277.

Local editor with 30 years experience offering professional services: to writers working on a memoir or novel, or looking for help to self publish. Hourly rates. Call 917-331 2201.

Real Estate

PUBLISHER’S NOTICE: Equal Housing Opportunity. All real estate advertised in this newspaper is subject to the Federal Fair Housing Act of 1966 revised March 12, 1989 which makes it illegal to advertise any preference, limitation, or discrimination based on race, color religion, sex, handicap or familial status or national origin or intention to make any such preference, limitation or discrimination. All residential property advertised in the State of Connecticut General Statutes 46a-64c which prohibit the making, printing or publishing or causing to be made, printed or published any notice, statement or advertisement with respect to the sale or rental of a dwelling that indicates any preference, limitation or discrimination based on race, creed, color, national origin, ancestry, sex, marital status, age, lawful source of income, familial status, physical or mental disability or an intention to make any such preference, limitation or discrimination.

Houses For Rent

Sharon, 2 Bd/ /2bth 1900 sqft home: on private Estate-Gbg, Water, Mow/plow included. utilities addtl. Please call: 860-309-4482.

Tag Sales

Falls Village, CT

Saturday November 8 Tag Sale in the Barn: 91 Main Street in Falls Village 10 to 3 pm. Please Park in town parking available along Main St. Tools, wood working tools, bench, furniture, antique doors, out door planters, Halloween and Christmas decorations and much more.

Keep ReadingShow less

loading