Latest News

Rock Steady Farm during the 2024 Farm Fall Block Party. This year’s event returns Sept. 6.

Provided

On Saturday, Sept. 6, from 12 to 5 p.m., Rock Steady Farm in Millerton opens its fields once again for the third annual Farm Fall Block Party, a vibrant, heart-forward gathering of queer and BIPOC farmers, neighbors, families, artists, and allies from across the Hudson Valley and beyond.

Co-hosted with Catalyst Collaborative Farm, The Watershed Center, WILDSEED Community Farm & Healing Village, and Seasoned Delicious Foods, this year’s party promises its biggest celebration yet. Part harvest festival, part community reunion, the gathering is a reflection of the region’s rich agricultural and cultural ecosystem.

Rooted in justice and joy, the event will feature over 25 local vendors and organizations, live performances, healing workshops, family-friendly activities (yes, there’s a bouncy castle), and abundant local food. And while the festivities are certainly reason enough to show up, organizers remind us the purpose runs deeper.

“This isn’t just a party. It’s a place to build the kind of relationships that keep our food system alive,” said Maggie Cheney, Rock Steady’s co-founder and worker-owner. “We’re creating space where farmers, growers, families, and community organizers can connect, celebrate, and support one another.”

Proceeds from the event support Rock Steady’s POLLINATE program for queer and trans BIPOC beginning farmers, as well as Catalyst Collaborative Farm’s food justice initiatives. With sliding-scale tickets from $5 to $250, the organizers aim to make the event accessible to all, including free entry for children under 12 and volunteer options for those who want to pitch in.

For those who’ve attended before, it’s a welcome return. For newcomers, it may just feel like coming home.

More info and tickets: rocksteadyfarm.com/farm-block-party

Keep ReadingShow less

The art of Marilyn Hock

Sep 03, 2025

Waterlily (8”x12”) made by Marilyn Hock

Provided

It takes a lot of courage to share your art for the first time and Marilyn Hock is taking that leap with her debut exhibition at Sharon Town Hall on Sept. 12. A realist painter with a deep love for wildlife, florals, and landscapes, Hock has spent the past few years immersed in watercolor, teaching herself, failing forward, and returning again and again to the page. This 18-piece collection is a testament to courage, practice and a genuine love for the craft.

“I always start with the eyes,” said Hock of her animal portraits. “That’s where the soul lives.” This attentiveness runs through her work, each piece rendered with care, clarity, and a respect for the subtle variations of color and light in the natural world.

After painting in oils earlier in life, Hock returned to art when she retired from working as a paralegal with a goal: to learn watercolor. It wasn’t easy.

“Oils and watercolor are opposites,” she explained. “With oils, you build your darks first. In watercolor, if you do that, you’re in trouble.” She studied online, finding instructors whose approach clicked, and adapted to the delicacy of the medium.

“When I’m working, everything else falls away,” she said. “It doesn’t matter what’s going on in life. While I’m painting, time disappears.”

Her studio, formerly a home office, is now her sanctuary and the pieces in this exhibition are the result of three years of that devoted studio work. While this is her first full public show, Hock previously tested the waters at a small fundraiser at Noble Horizons, where one of her pieces sold. That experience — and the consistent encouragement from her family, especially her husband — pushed her to pursue a full exhibition. With gentle encouragement from her husband and family, Hock reached out to the Town Hall’s curator, Zelina Blagden. “My husband kept saying, ‘You’re as good as all those other people out there, why not show your work?’” And so, here it is.

All paintings in the show are for sale, though Hock admits a few are priced high — not because of their size or complexity — but because she’s not quite ready to let them go. “There are a couple I’ve priced high because I’m not sure I want to part with them. But we’ll see,” she laughed. “It would be nice to support the habit a little bit.”

As for aspiring artists or anyone hesitating to begin something creative, Hock’s advice is simple: “Go for it. If it fails, toss it in the basket and start over.”

The exhibit will be on view at Sharon Town Hall through Oct. 31 with an opening reception on Sept. 12 from 5:30 to 7:30 p.m. Light refreshments will be served.

Keep ReadingShow less

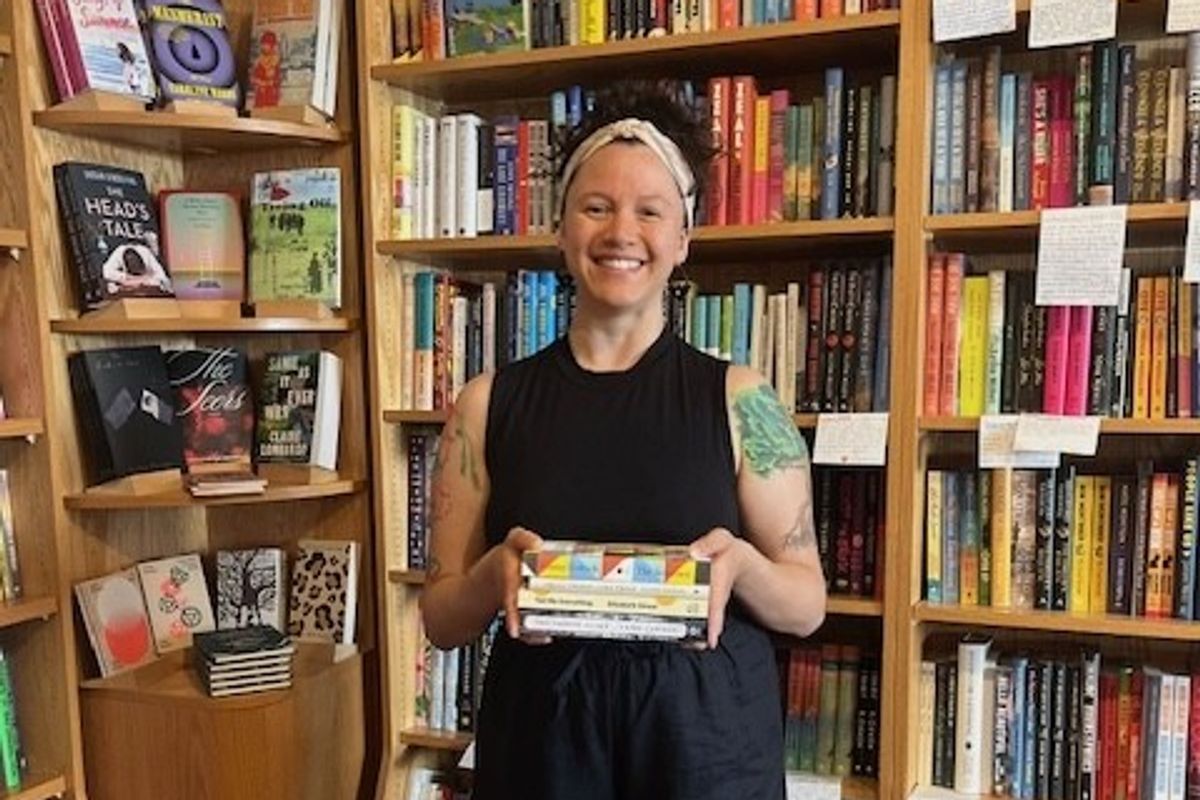

Carissa Unite, general manager of Oblong Books in Millerton.

Provided

Carissa Unite of Millerton, began working at Oblong Books 16 years ago as a high schooler. She recently celebrated her eight-year anniversary as the general manager.

Unite’s journey at Oblong began even before she applied for her first position.An avid reader from a young age, she was a frequent customer at the store. During those years, Unite bonded with a former employee who encouraged her to apply for a position after connecting over their shared love of reading.

As a teenager, Unite enjoyed reading Ellen Hopkins, John Green and Ann Brashares. With the busyness of adulthood, she now favors the convenience of audio books. In the past year, however, she has made it a point to read more physical books.

With a preference for contemporary fiction, she raved about “Atmosphere” by Taylor Jenkins Reid. The story, set in the 1980s, follows two women who become astronauts at a time when women were not widely accepted in the field. A beautiful love story emerges between the two characters. Unite described the writing as sensational and commended Reid’s ability to tackle complex themes without them being muddied.

Unite has developed a deep appreciated for classic literature. Her two favorites are “Giovanni’s Room” by James Baldwin and “The Picture of Dorian Gray” by Oscar Wilde. She was amazed by the philosophical nature of both words and the way their dialogue challenged her perspective.

In an effort to read beyond her preferred genre, she recommends the following:

“Some Desperate Glory,” by Emily Tesh, “Midnight Rooms,” by Donyae Coles and “Clear” by Carys Davies.

For Unite, the beauty of reading lies in its power to develop perspective, empathy, and compassion. Through books, readers learn that everyone is fighting different battles and no two stories are the same. She encourages people to choose kindness because you never know what someone else is facing.

Above all, reading brings Unite peace. If offers transcendence to another world, a pause from outside noise, and for Unite, it is where she feels most at home.

For anyone hesitant to being reading, Unite suggests: just do it! Read 10 pages a day and find the book that speaks to you. Any Oblong staff member would be happy to offer recommendations.

Oblong is located at 26 Main St., in Millerton and 6422 Montgomery St. in Rhinebeck.

Keep ReadingShow less

loading