Latest News

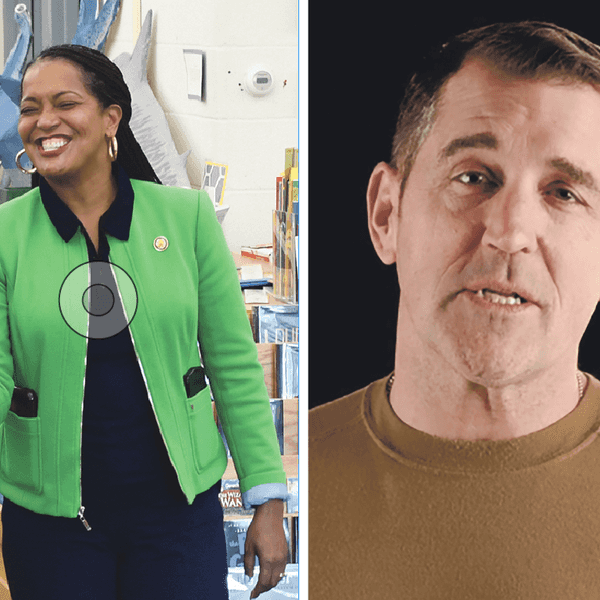

Christine Gray, left, and Jill Cutler discuss housing at Thursday’s meeting on the town’s Plan of Conservation and Development.

Ruth Epstein

CORNWALL — Channeling former New York City Mayor Ed Koch’s signature question, “So how am I doing?” the designers of the town’s Plan of Conservation and Development gathered to assess how well its goals are being carried out.

Participants from the plan’s four publicly selected focus areas attended a session hosted by the Planning and Zoning Commission on Thursday, Feb. 5. The four areas targeted for study are housing, natural resources, economic development and youth, community and cultural resources. Before participants broke out into separate groups, commission Chairman Anna Timell gave a brief presentation.

Timell explained that the state requires each town to develop a plan every 10 years outlining goals residents want to achieve to improve their community. Grants are tied to the submission of those plans, “so we take ours pretty seriously,” she said, adding, “It’s pretty remarkable what we’ve accomplished in the past five years.”

She described the start of the process in 2019, which included informational meetings to gather public input and a town meeting to approve the document. She said interest was high, as reflected by strong attendance at those sessions.

Timell suggested that participants consider which goals have not yet been addressed, what obstacles remain and how progress might be approached differently.

At the housing table, Jill Cutler of the Cornwall Housing Corp. said one of the plan’s goals was to build 25 affordable apartments over the 10-year period, a benchmark that has not yet been met. Limited available land remains one of the biggest challenges, she said.

Cutler noted that the group is exploring a former brownfield site on Route 7 South as a potential location for housing, but said funding would need to be raised to acquire the property.

Rising housing costs, she added, are making it increasingly difficult for many residents to purchase homes or rent apartments considered “affordable.”

She said the group could consider working with the Torrington Area Health District and the Department of Energy and Environmental Protection to allow for unconventional septic systems, noting there are some low-cost alternatives.

Another potential barrier is the town’s three- and five-acre minimum parcel requirement in residential zones, though Cutler said there are differing views on whether that standard should be revised. Christine Gray of the Planning and Zoning Commission pointed out the regulations were altered to allow for one-quarter lots and five-foot setbacks in the West Cornwall business district.

Those at the economic development table discussed ways to attract businesses to Cornwall Bridge.

Bruce Bennett said businesses that support other businesses would be beneficial. “We need someone who can solicit businesses,” he said, adding that having a chamber of commerce might be helpful.But Steve Saccardi said it’s hard for a town to seek out new enterprises. “You’re asking people to take a gamble.”

Mare Rubin said there are two distinct types of businesses: brick-and-mortar establishments that customers visit and tradespeople who travel to their clients. “We need awareness of both,” she said.

Saccardi also attended the group discussing youth, community and cultural resources, where participants spoke of the need to develop more social programs for individuals who may feel isolated. They also said newcomers could be targeted to get involved in volunteer activities.

Brad Harding was at the natural resources table where the discussion centered on environmental groups sharing common goals. He said the Planning and Zoning Commission is already working with the Conservation Commission, which is having positive results.

Keep ReadingShow less

The town’sCemetery Committee plans to restore the overgrown Morehouse Cemetery off Richards Road, where a large fallen tree once grew directly from the graveyard.

Alec Linden

KENT — The Town of Kent officially assumed stewardship of two long-neglected historic graveyards in January, resolving a years-long gap in ownership.

The small burial grounds, known as the Morehouse and Parcells cemeteries, had previously been owned and maintained by the Kent Cemetery Association, which disbanded in 2023. While it operated, the association oversaw the town’s cemeteries, but its dissolution left several sites without an owner.

The town formed a Cemetery Committee in 2024 to take over maintenance of the burial grounds in Kent. When the committee’s charter was drafted, however, the Morehouse and Parcells cemeteries were inadvertently left out, leaving them without established ownership for several years.

Lorry Schiesel, chair of the Cemetery Committee, said at a January meeting that the formal acquisition of the two plots — each roughly 25 by 25 feet — corrects that oversight. The Morehouse Cemetery, located just off Richards Road, contains three standing headstones. The Parcells Cemetery, which sits on private property within the St. Johns Peak development, has two.

With the acquisition of the Morehouse and Parcells sites, Schiesel said the committee is now eligible to apply for grants to revamp these cemeteries. The state Office of Policy and Management offers funding through its Neglected Cemetery Account Grant Program, which supports small, unkempt cemeteries. Before the acquisition, the town did not own any qualifying cemeteries.

If the application is successful, Schiesel said the funds would be used for cleanup and maintenance of the two graveyards, neither of which has seen a burial in more than a century.

The primary focus would be on rehabilitating the Morehouse Cemetery, which not only has three standing headstones but may also contain additional burials obscured by invasive vines and a large fallen tree.

Little is known about those buried there, Schiesel said. However, Marge Smith, curator at the Kent Historical Society, located an old newspaper clipping identifying the graves as belonging to brothers Norman and Joseph Morehouse and their father, David Morehouse Jr. The sons died in 1837 and 1844, long before their father, who died during the Civil War period. He was buried between the two boys.

Smith said the clipping was donated to the historical society without a date or information about its original publication.

According to the article, both brothers died before the age of 30, and their epitaphs are noteworthy.

Joseph’s headstone reads:

“How short the course our friend hath run, cut down in all his bloom. The race but yesterday begun, now finished in the tomb.”

Norman’s inscription is taken from William Shakespeare’s self-written epitaph in England:“Good friend for Jesus’ sake forbeare, to dig the dust enclosed here. Blest be the man who spares these stones, and cursed be he that stirs my bones.”

While details surrounding the deaths of the father and sons are unclear, Smith said the family has a long-standing legacy in town. “They’ve got tentacles all over the place,” she said, including in the once-iconic Main Street department store N.M. Watson.

“We all did our shopping there when we were kids… Everybody went to Watson’s,” Smith said, explaining that the store was opened by a direct descendant of Daniel Morehouse, brother to David Morehouse Jr., who is buried in the Richards Road plot.

Similarly little is known about those interred in the small, fenced-in Parcells cemetery, found on private property adjacent to a driveway.

Daniel Parcells died in 1905 at age 93, outliving his wife by 15 years. His low, flat, smooth stone appears far more modern than Martha’s taller, weathered headstone. Town Sexton Brent Kallstrom said he is unsure why Daniel’s stone looks newer but speculated that it may have been replaced by family members at some point.

The Parcells family once owned a large farm on the mountain where the St. Johns Peak development now stands, and several descendants remained in the Kent area.

One of those descendants was Flora Louise Benedict, the daughter of Daniel and Martha Parcells, who became the victim of a grisly murder case that made regional headlines in 1922. A May 17 article in the Winsted Evening Citizen, published before a suspect was captured, ran under the subhead: “Sidney Ward, Addicted to Drink and in Spirit of Revenge, Kills Mrs. Flora Louise Benedict, Aged 81, and Shoots Her Daughter, Mrs. Cora Page, But Not Fatally.”

The article identified Ward as a former farmhand of Benedict, who was also the widow of a South Kent farmer, German Benedict.

Smith said that she remembers Cora Page from her childhood in Kent, and that the murder was well known. “It’s just a heartbreaking story,” she said.

Lurid tales aside, Smith said she hopes the town takes good care of the little burial sites, given that they have so much history. “They’ve survived so long,” she said.

Schiesel said the acquisition of the two historic burial sites helps fulfill the committee’s mission of honoring Kent’s past residents.

“None of us quite knew what we were getting into,” she said of the committee’s early days, “but it really feels like you’re honoring people and the past.”

Keep ReadingShow less

About Compass

Feb 11, 2026

Beginning this week, readers will see a redesigned Compass section, focused on arts and lifestyle coverage from across the region. This update marks the first step in an expanded approach to arts and lifestyle reporting.

Compass covers the creative, cultural and everyday activity that shapes life here — the work people make, the places they gather and the ways communities express themselves. Arts and lifestyle reporting is part of the broader story of this area and an essential record of how people live.

New this week is the introduction of a regular community profile highlighting individuals who contribute to the region’s cultural life through creative work, long-standing involvement in local institutions, or by simply making life here more interesting.

Arts and lifestyle coverage is not only about documenting what has already happened. Compass will continue to emphasize reporting on events and activities readers can take part in — performances, exhibitions, talks, festivals and outdoor activities.

We’re also seeking new voices. We welcome story ideas, tips and pitches, and we’re interested in working with writers and photographers who want to contribute thoughtful, independent arts and lifestyle coverage. Send inquiries to nataliaz@lakevillejournal.com.

We look forward to your feedback.

Keep ReadingShow less

loading