Latest News

Recount confirms Bunce as new First Selectman

Recount confirms Bunce as new First Selectman

NORTH CANAAN — A recount held Monday, Nov. 10, at Town Hall confirmed Democrat Jesse Bunce’s narrow victory over incumbent First Selectman Brian Ohler (R) in one of the tightest races in town history.

“A difference of two votes,” said recount moderator Rosemary Keilty after completing the recanvass, which finalized the tally at 572 votes for Bunce and 570 for Ohler.

“It’s overwhelming,” said Bunce after the result. To the poll workers he said, “Thank you everyone for your hard work. It’s been an honor.” And he thanked Ohler for his service to the town.

The two men shook hands.

“Congratulations,” said Ohler. “Wish you all the best. When you succeed, the Town of North Canaan succeeds and that’s why we’re all here.”

Ohler will continue on the board as a selectman. Newcomer Melissa Pinardi (R) will fill the third seat on the board.

The recount was required by state law after the initial count on Election Day showed a difference of three votes (572 to 569).

Ohler gained one vote in the recount and Bunce’s total was unchanged. Keilty said the extra vote was likely from a ballot that the tabulator did not read properly last Tuesday.

There was a single ballot that was not counted because the voter selected both Ohler and Bunce for first selectman.

Looking ahead to the coming term, Bunce said he was ready to get to work. “We have a good game strategy of how we’d like to handle the first 90 days and I look forward to executing that,” he said. “I think we can do lots of fun, exciting things for the town that’ll benefit all sorts of people.”

In a follow up statement, Ohler wrote, “The future of North Canaan is bright.” He continued, “Now is not the time to wish failure or misstep upon any elected official. We will all serve each other and our town, just as your votes intended them to do. It has been an immense honor to serve as your First Selectman... We are North Canaan.”

The first meeting of the new Board of Selectmen will be held in Town Hall Monday, Dec. 1, at 7 p.m.

Keep ReadingShow less

photo by ruth epstein

Brent Kallstrom, commander of Hall-Jennings American Legion Post 153 in Kent, gives a Veterans Day message. To the left is First Selectman Martin Lindenmayer, and to the right the Rev. John Heeckt of the Kent Congregational Church.

KENT – The cold temperatures and biting winds didn’t deter a crowd from gathering for the annual Veterans Day ceremony Tuesday morning, Nov. 11.

Standing in front of the memorials honoring local residents who served in the military, First Selectman Martin Lindenmayer, himself a veteran, said the day is “not only a time to remember history, but to recognize the people among us—neighbors, friends and family—who have served with courage, sacrifice and devotion. Whether they stood guard in distant lands or supported their comrades from home, their service has preserved the freedoms we enjoy each day.”

While veterans live by the words duty, honor, country, said Lindenmayer, it doesn’t mean they are warmongers. “The soldier, above all, prays for peace.” He told the veterans the town is proud of them. “We pledge to honor your service not only with words, but with our actions—by building a community and a country worthy of your sacrifice.”

Brent Kallstrom, commander of Hall-Jennings American Legion Post 153, gave a message from the American Legion in which he said Veterans Day can be traced to the armistice that ended World War I.

“For many veterans, our nation was important enough to endure long separations from their families, miss the births of their children, freeze in sub-zero temperatures, bake in wild jungles, lose limbs and far too often, lose their lives,” he said.

He noted that fewer than 10% of Americans can claim the title veteran and less than one half of 1% of the population currently serves.

“Veterans have given us freedom, security and the greatest nation on earth,” said Kallstrom. “It is impossible to put a price on that.”

Local veterans shot three rounds and bagpiper Don Hicks provided music. The Rev. John Heeckt of the Kent Congregational Church gave the invocation and the Rev. Richard Clark of St. Andrew’s Episcopal Church gave a concluding prayer.

Members of St. Andrew’s then hosted a luncheon for all veterans and their families.

Keep ReadingShow less

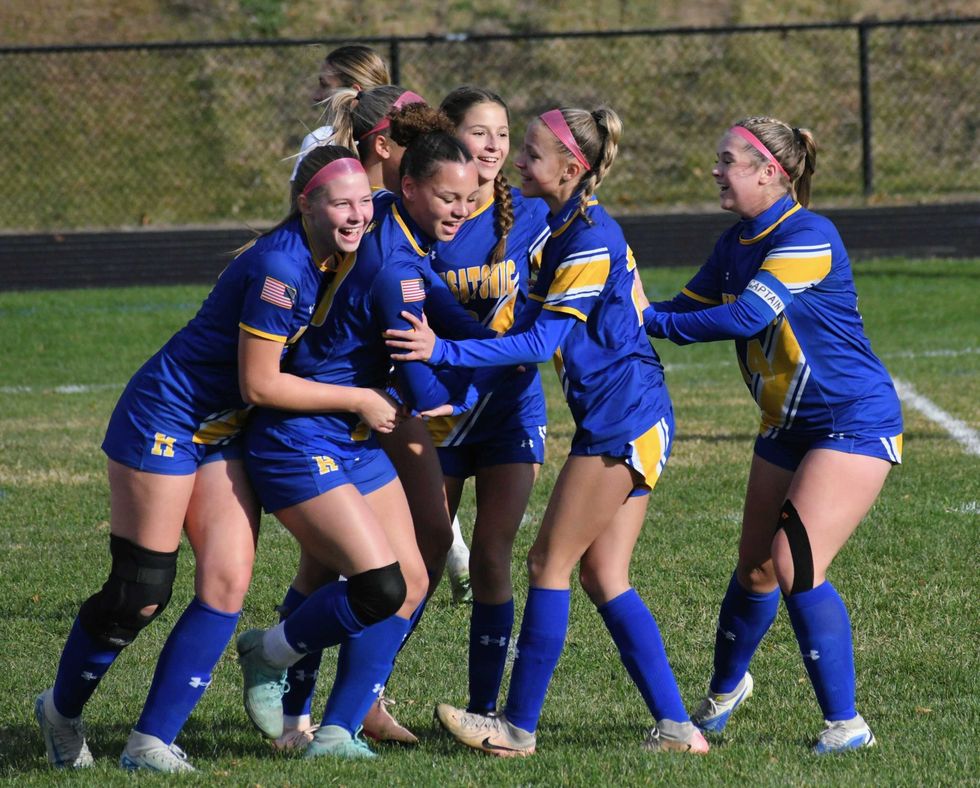

Ava Segalla, Housatonic Valley Regional High School's all-time leading goal scorer, has takes a shot against Coventry in the Class S girls soccer tournament quarterfinal game Friday, Nov. 7.

Photo by Riley Klein

FALLS VILLAGE — Housatonic Valley Regional High School’s girls soccer team is headed to the semifinals of the state tournament.

The Mountaineers are the highest seeded team of the four schools remaining in the Connecticut Interscholastic Athletic Conference Class S playoff bracket.

HVRHS (3) will play Morgan High School (10) in the semifinals. On the other side of the bracket, Canton High School (4) will play Old Saybrook High School (9). The winners of both games will meet in the Class S championship game.

To start the tournament, HVRHS earned a first-round bye and then had home-field advantage for the second-round and quarterfinal games.

In the second round Tuesday, Nov. 4, HVRHS won 4-3 against Stafford High School (19) in overtime. Ava Segalla scored three goals for Housatonic, including the overtime winner, and Lyla Diorio scored once. Bella Coporale scored twice for Stafford and Gabrielle Fuller scored once.

HVRHS matched up against Coventry High School (11) in the quarterfinal round Friday, Nov. 7. In the 2024 tournament, Coventry eliminated the Mountaineers in the second round.

Revenge was served in 2025 with a 4-2 win for HVRHS. Segalla scored her second hat trick of the tournament and Georgie Clayton scored once. Coventry’s goals came from Jianna Foran and Savannah Blood.

“The vibes are great,” said HVRHS Principal Ian Strever at the quarterfinal game.

The semifinal against Morgan will be played Wednesday, Nov. 12, on neutral ground at Newtown High School.

If HVRHS wins, it will mark the girls soccer team’s first appearance in the Class S title game since 2014.

Morgan was the runner-up in last year’s Class S girls soccer tournament, losing in penalty kicks to Coginchaug High School.

Keep ReadingShow less

Legal Notices - November 6, 2025

Nov 05, 2025

Legal Notice

The Planning & Zoning Commission of the Town of Salisbury will hold a Public Hearing on Special Permit Application #2025-0303 by owner Camp Sloane YMCA Inc to construct a detached apartment on a single family residential lot at 162 Indian Mountain Road, Lakeville, Map 06, Lot 01 per Section 208 of the Salisbury Zoning Regulations. The hearing will be held on Monday, November 17, 2025 at 5:45 PM. There is no physical location for this meeting. This meeting will be held virtually via Zoom where interested persons can listen to & speak on the matter. The application, agenda and meeting instructions will be listed at www.salisburyct.us/agendas/. The application materials will be listed at www.salisburyct.us/planning-zoning-meeting-documents/. Written comments may be submitted to the Land Use Office, Salisbury Town Hall, 27 Main Street, P.O. Box 548, Salisbury, CT or via email to landuse@salisburyct.us. Paper copies of the agenda, meeting instructions, and application materials may be reviewed Monday through Thursday between the hours of 8:00 AM and 3:30 PM at the Land Use Office, Salisbury Town Hall, 27 Main Street, Salisbury CT.

Salisbury Planning & Zoning Commission

Martin Whalen, Secretary

11-06-25

11-13-25

Notice of Decision

Town of Salisbury

Planning & Zoning Commission

Notice is hereby given that the following action was taken by the Planning & Zoning Commission of the Town of Salisbury, Connecticut on October 20, 2025:

8-24 referral was deemed consistent with the Plan of Conservation and Development - For the use of town-owned land at 20 Salmon Kill Road, Salisbury for housing, recreation, and conservation. The property is shown on Salisbury Assessor’s Map 11 as Lot 26.

Any aggrieved person may appeal these decisions to the Connecticut Superior Court in accordance with the provisions of Connecticut General Statutes §8-8.

Town of Salisbury

Planning &

Zoning Commission

Martin Whalen, Secretary

11-06-25

Notice of Decision

Town of Salisbury

Inland Wetlands & Watercourses Commission

Notice is hereby given that the following actions were taken by the Inland Wetlands & Watercourses Commission of the Town of Salisbury, Connecticut on October 27, 2025:

Exempt - Application IWWC-25-75 by Elaine Watson to install a 4’ by 45’ removable dock adjacent to the high-water mark of Lake Wononscopomuc. The property is shown on Salisbury Assessor’s map 47 lot 11 and is a vacant parcel located between 123 & 137 Sharon Road, across from and associated with 126 Sharon Road. The owners of the property are Paul and Elaine Watson.

Approved with the condition that any additional permits required for this project are filed with the Land Use Office - Application IWWC-25-74 by Richard Riegel, Principal of Lime Rock Park II, LLC to reinforce compromised river bank and implement riparian restoration in partnership with Trout Unlimited. The property is shown on Salisbury Assessor’s map 04 lot 16 and is known as 497 Lime Rock Road, Lakeville. The owner of the property is Lime Rock Park II, LLC.

Approved - Application IWWC-25-72 by George Johannesen of Allied Engineering Associates, Inc. for an addition to the existing house, construct garage, relocate driveway, landscaping. The property is shown on Salisbury Assessor’s map 08 lot 03 and is known as 396 Salmon Kill Road, Lakeville. The owners of the property are Randall Allen and Margaret Holden.

Approved subject to conditions recommended by the Town Consulting Engineer and the relinquishment of permit 2024-IW-036 - Application IWWC-25-69 by Bob Stair to construct an addition to the existing house and driveway in the upland review area. The property is shown on Salisbury Assessor’s map 67 lot 07 and is known as 300 Between the Lakes Road, Salisbury. The owner of the property is 280 BTLR LLC.

Approved subject to conditions recommended by the Town Consulting Engineer - Application IWWC-25-73 by Hotchkiss School (Michael J. Virzi) for a restoration plan for the existing temporary dining building at the Hotchkiss School. The property is shown on Salisbury Assessor’s map 06 lot 09 and is known as 22 Lime Rock Road, Lakeville. The owner of the property is Hotchkiss School.

Any aggrieved person may appeal this decision to the Connecticut Superior Court in accordance with the provisions of Connecticut General Statutes §22a-43(a) & §8-8.

11-06-25

NOTICE TO CREDITORS

ESTATE OF

DEBRA ANN WHITBECK

Late of North Canaan

(25-00419)

The Hon. Jordan M. Richards, Judge of the Court of Probate, District of Litchfield Hills Probate Court, by decree dated October 16, 2025, ordered that all claims must be presented to the fiduciary at the address below. Failure to promptly present any such claim may result in the loss of rights to recover on such claim.

The fiduciary is:

Donna L. Cooke

65 Orchard Street

North Canaan, CT 06018

Megan M. Foley

Clerk

11-06-25

NOTICE TO CREDITORS

ESTATE OF

THOMAS CROSBY DOANE

Late of North Canaan

(25-00388)

The Hon. Jordan M. Richards, Judge of the Court of Probate, District of Litchfield Hills Probate Court, by decree dated October 9, 2025, ordered that all claims must be presented to the fiduciary at the address below. Failure to promptly present any such claim may result in the loss of rights to recover on such claim.

The fiduciary is:

Jase Doane

5 Clearwater Lane

East Hampton, CT 06424

Megan M. Foley

Clerk

11-06-25

Keep ReadingShow less

loading