Latest News

Eddie Jacob was recently promoted to Assistant Brokerage Manager for four Litchfield Hills offices of William Pitt Sotheby’s International Realty.

Photo provided

William Pitt Sotheby’s International Realty has appointed Eddie Jacob as Assistant Brokerage Manager for its four Litchfield Hills offices, the company announced on Nov. 19.

In his new role, Jacob will support agents and help oversee operations in the firm’s Kent, Litchfield, Salisbury and Washington Depot brokerages.

He joined the company’s Litchfield office as a sales advisor in 2024 after more than a decade managing high-pressure workflows in the legal services and global translation industries.

Before moving into real estate, Jacob coordinated teams across New York, San Francisco, London and Hawaii, handling rapid-turnaround projects for law firms, federal agencies and international corporations.

“Real estate feels very similar,” said Jacob, who acted as the go-between for clients and linguists during eight deadlines and significant cases. “Buyers, sellers, attorneys and agents are often dealing with stressful situations, and my job is to keep things steady and moving forward.”

“The fast-paced environment I came from taught me how to stay calm, focused and organized—skills that will be instrumental in my new role.”

Jacob, who lives in Morris with his wife, Molly, said he was drawn to real estate as a way to more deeply engage with the Litchfield County community. The couple is expecting their first child this winter.

In Morris, Jacob serves as chairman of the town’s Ordinance Committee and has worked with regional partners, including South Farms, where he helped bring the brokerage on as a supporter of the venue’s summer music series.

He also previously co-managed a boutique entertainment company producing seasonal music events in New York City, an experience that further strengthened his ability to coordinate teams and community-facing programs.

Julie King, brokerage manager for William Pitt Sotheby’s, said Jacob’s promotion reflects his steady rise within the firm.

“Eddie has quickly distinguished himself as a thoughtful collaborator, a trusted resource for his peers and an engaged member of the community,” said King. “His professionalism, adaptability and commitment to supporting others have made him a natural fit for this leadership role.”

Jacob will assist in shaping strategy, strengthening office operations and supporting more than 100 agents across the Litchfield Hills region.

Founded in 1949, William Pitt Sotheby’s International Realty and Julia B. Fee Sotheby’s International Realty manages a $5.1 billion portfolio with more than 1,100 sales associates in 29 brokerages spanning Connecticut, Massachusetts and New York.

Keep ReadingShow less

Winter sports season approaches at HVRHS

Dec 05, 2025

Mohawk Mountain was making snow the first week of December. The slopes host practices and meets for the HVRHS ski team.

By Riley Klein

FALLS VILLAGE — After concluding a successful autumn of athletics, Housatonic Valley Regional High School is set to field teams in five sports this winter.

Basketball

Berkshire League basketball tips off Tuesday, Dec. 14. HVRHS’s girls' and boys' squads will face Nonnewaug High School to start the season. The boys' varsity team is under new leadership this year with the addition of head coach Bobby Chatfield. The boys will be out for revenge in the season opener at Nonnewaug, which knocked HVRHS out of the BL postseason tournament last year.

The girls will be at home Dec. 14 for the first league game of the basketball season. Coach Jake Plitt returns for his fourth season at the helm. Last year, the HVRHS girls were eliminated in the semifinals of the BL tournament by Northwestern Regional High School on their way to repeating as champions.

Hockey

Ice hockey players have joined a co-op team this year with New Milford High School. Two HVRHS athletes will be on the team: Logan Miller and Melanie Rundall.

Games and practices will be held at Canterbury School’s O’Neil Arena. The first official hockey game of the 2025-26 season will be Dec. 17 at home against the Newtown-New Fairfield co-op.

The Housatonic co-op team that was previously led by coach Dean Diamond disbanded after last season due to a player shortage. The New Milford co-op is led by coach Hank Dietter.

Swimming

The HVRHS swim team will begin the season with a road stretch. The first meet will be held Dec. 18 at Shepaug Valley High School, followed by meets at Northwestern and then Lakeview High School. The first home meet for the swim team will be Jan. 14 against Nonnewaug, held at The Hotchkiss School’s pool.

New to the team this year is freshman Phoebe Conklin, who competed at the YMCA National Long Course Swimming Championships in Ocala, Florida, this past summer. Conklin qualified for nationals in the 50-meter freestyle, 100-meter freestyle and 100-meter butterfly. The HVRHS swim team is coached by Jaqueline Rice.

Skiing

The HVRHS ski team practices and competes at Mohawk Mountain ski area in Cornwall. Competition will hit the slopes beginning with a group meet at home Wednesday, Jan. 14.The HVRHS ski team is coached by Bill Gold.

Indoor track

The last winter sport to get underway will be indoor track. Silas Tripp was the lone Mountaineer to sign up for the sport. He will represent HVRHS in meets, but travel with Lakeview athletes to meets. The first scheduled event will be at Bethel the weekend of Feb. 6 to Feb. 8.

Keep ReadingShow less

A mother bear and her cubs move through a backyard in northwest Connecticut, where residents told DEEP that bear litters are now appearing more frequently.

By James H. Clark

SHARON — About 40 people filled the Sharon Audubon Center on Wednesday, Dec. 3, to discuss black bears — and most attendees made clear that they welcome the animals’ presence. Even as they traded practical advice on how to keep bears out of garages, porches and trash cans, residents repeatedly emphasized that they want the bears to stay and that the real problem lies with people, not wildlife.

The Connecticut Department of Energy and Environmental Protection (DEEP) convened the meeting as the first in a series of regional Bear Management Listening Sessions, held at a time when Connecticut is increasingly divided over whether the state should authorize a limited bear hunt. Anticipating the potential for heated exchanges, DEEP opened the evening with strict ground rules designed to prevent confrontations: speakers were limited to three minutes, directed to address only the panel of DEEP officials, and warned that interruptions or personal attacks would not be tolerated.

“We really want to hear from you,” said Justin Davis, DEEP’s bureau chief for natural resources, at the meeting. He said that DEEP is preparing a bear management report in early 2026 that evaluates the challenges the state is facing and the strategies going forward dealing with them. He said the report will include feedback from the public generated at the listening sessions. He urged attendees, however, not to turn the meeting into a discussion about whether there should be a hunt or not.

Davis called the return of black bears to Connecticut a “conservation success story,” but one that now comes with challenges. "They're large animals, they're powerful and they can become comfortable being around people--and they're opportunistic, and they love to eat."

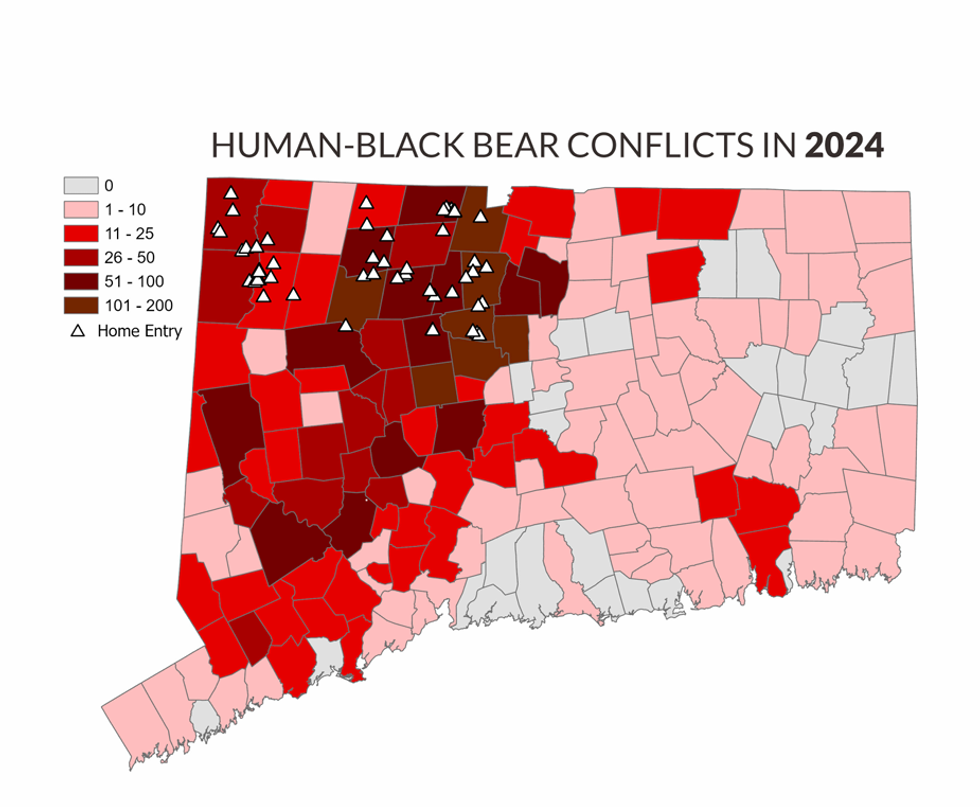

DEEP shared data showing that black bears have been reported in nearly every Connecticut town and that conflicts involving trash, bird feeders, livestock and home entries have increased sharply in recent years. The state’s bear population was last estimated at roughly 1,100 to 1,200 animals, a number that DEEP recognizes has grown since the study was conducted in 2012.

Eric Hammering, the office director of Environmental Review & Strategic Initiatives at DEEP, told the attendees that since 2020 there have been 264 reported home entries in 38 municipalities in northwest Connecticut, citing data from the state's State of the Bears report released in March.

A home entry, he said, is defined as an event when a bear actually goes inside a resident's living space.

DEEP officials stressed that bird feeders and unsecured household trash are the two biggest drivers of bear conflicts. They advise residents to remove feeders entirely and keep their garbage inside or in bear-resistant containers. DEEP representatives noted that once a bear discovers food, it is likely to develop habits and return.

Many attendees said they see widespread noncompliance in their neighborhoods — particularly among part-time residents and short-term rental guests who leave trash out for days. Several said they were frustrated that the people causing the problem are often not the ones who attend sessions like this.

As a result, a number of residents called for stronger statewide enforcement, including fines for leaving trash unsecured and penalties for repeated violations. Without consequences, they said, the same households will continue to attract bears and put neighbors at risk. Others described practical steps to reduce bear activity--including the use of secure dumpsters, food composting stations, and the placement of electric fencing around livestock and beehives.

Again and again, residents emphasized that the underlying issue is human behavior. One attendee summarized it succinctly: “There are 3.6 million people in Connecticut and far fewer bears. Human behavior is the problem.”

Lynn Levine, a Litchfield resident who enjoys seeing bears, said common sense steps are the answer. She said that when she first moved to the area, she mistakenly left her garage down open with a 15-pound bag of shelled peanuts inside. "A bear dragged the bag around the side of the garage, sat down and had a teddy bear picnic." She said she learned not to leave the garage door open, especially with food inside.

Not all the stories were lighthearted. An 82-year-old Sharon woman recounted repeated break-ins that left her shaken and facing thousands of dollars in repairs, including a bear walking into her kitchen while she was washing dishes. A veterinarian described livestock attacks, including an alpaca that was mauled and dragged. A farmer said bears caused about $160,000 in crop losses in one year and that cornfields across the region face similar damage.

Several speakers added that DEEP’s limited staffing means local police often end up responding when bears are struck by cars or behaving aggressively.

People are frightened

Cornwall First Selectman Gordon Ridgway, who attended the session, said afterward that he was troubled by how outdated the state’s population data is.

“My biggest personal take-away was surprise — that DEEP doesn’t have a handle on how many bears are here,” he said. “They said they haven’t surveyed them since 2012. How do you make a plan or policy without doing a survey?”

Ridgway said Cornwall has received about 40 bear-related reports this year, including home and vehicle entries and injuries to pets. “People are frightened by intrusions onto their property,” he said. “These are not happy stories.”

He noted that in 2012 -- when the state said it last did its population count -- “a bear was a novelty,” but sightings today are very common. “Today, most people see a bear every week. It’s no longer a novelty — it’s a real issue.”

Ridgway said he supports developing a statewide management plan and wants Connecticut to examine approaches used in other states, including reducing their numbers.

While most attendees at the Dec. 3 session indicated they opposed a hunt, Ridgway said that is not a true reflection of how his constituents in Cornwall view the issue. “If we had a vote, it would be close as to whether there should be a hunting season.”

Only one resident called for a hunt

Only one attendee — a longtime hunter from West Cornwall — advocated for a controlled bear hunt. He argued that the population is “exploding” and that education and bear-proof containers are “a band-aid.” In keeping with DEEP’s rules, other residents did not respond, and the session took place without conflict.

Much of the remaining discussion centered on unsecured trash, short-term rentals, and outdated dumpsters at state parks that residents say train bears to expect human food. Some questioned why the listening session was not better publicized, and Ridgway echoed that concern, saying it should have also been held at the high school to allow more residents to attend.

DEEP collected comment cards at the end of the session. Staff said all feedback will be reviewed as the agency drafts its statewide bear management report.

Keep ReadingShow less

Rick Osborne, manager of the Kent Transfer Station, deposits the first bag of food scraps into a new organics “smart bin.” HRRA Executive Director Jennifer Heaton-Jones stands at right, with Transfer Station staff member Rob Hayes at left.

By Ruth Epstein

KENT — Residents now have access to around-the-clock food-scrap composting thanks to two newly installed organics “smart bins,” unveiled during a ribbon-cutting ceremony Monday morning, Dec. 1.

Rick Osborne, manager of the Kent Transfer Station, placed the first bag of food scraps into the smart bin located at 3 Railroad St. A second bin has been installed outside the Transfer Station gate, allowing 24/7 public access even when the facility is closed.

The initiative is part of a regional effort to expand composting opportunities and reduce the amount of waste sent to state trash facilities. Housatonic Resources Recovery Authority Executive Director Jennifer Heaton-Jones, who attended the ceremony, said the bins demonstrate what small towns can achieve in addressing Connecticut’s broader waste challenges.

“This is proof that even our smallest towns can make a big difference in tackling the waste crisis in our state,” Heaton-Jones said.

Also present at the event was Transfer Station staff member Rob Hayes.

Keep ReadingShow less

loading