In a few months, be prepared for politicians of both parties to turn up the heat as the June debt ceiling deadline approaches. Normally, the stock market responds with increased volatility. The question is should investors pay attention at all?

That may sound like heresy given that we are talking about the full faith and credit of the United States of America. If the government defaults on its debt, the global repercussions of such an event would be momentous. Currencies would plummet, stocks would crash, and interest rates would soar. Armageddon would reign, or at least that’s what is predicted to happen, but no one knows for sure because the U.S. has never defaulted on its fiscal responsibilities.

“But there could always be a first time,” you might say. And that is exactly why politicians can hold the nation hostage to advance their political careers while making outlandish demands that they know will never become law.

Legislation establishing a debt ceiling was passed in 1939. Congress has revamped the limit 100 times since World War II. Back then, Congress was more heavily involved in federal borrowing, as opposed to today, where the focus is solely on spending. For those who are unaware, the debt limit is not in the Constitution, nor in any of its 27 amendments. It is at best, a statute (law) that gives politicians a chance to disrupt, lie, evade, and create headaches for the country whenever they please.

The biggest joke of all is that the debt limit reflects money that has already been spent and is now owed to others. Has it ever stopped Congress from spending more money? No, at most it just redistributes spending into different areas such as more in defense, less in social programs, or vice versa for a short time. Given that it serves no policy purpose whatsoever, why have one?

Because it is an immense bargaining chip for some.

Fear of default gives leverage to those who have none. All that is necessary is to threaten while stretching out any compromise agreement to the last possible moment. By doing so, they are counting on the financial markets to become unwilling negotiators on their behalf. Those leading the opposition to raise the debt limit receive enormous coverage by the media.

Demands for programs and legislation, no matter how outlandish, that have nothing to do with the debt limit give politicians a national forum and unearned legitimacy. Debt limits become the saving grace for the economy and the nation for a few short months. However, when they finally do vote to raise the limit, few hear about it.

Unfortunately, all this rhetoric seeps into the national consciousness. In a recent poll by the Economist, only 38% of U.S. adult citizens (and only 20% of Republicans) think Congress should raise the debt ceiling. Given those numbers, it is no wonder that agreeing to pay the debts we already owe has become an extremely partisan affair.

As for those on the other side of the debate, in this case, the Biden Administration, there are different avenues available to them if they choose to take them. The U.S. Treasury, for example, could stop making some payments (Social Security and congressional salaries, for example), while coupon and principal payments continue to be paid in full out of tax revenues.

A more drastic direction would be to keep the debt ceiling in place, but the Treasury borrows more money anyway arguing that failing to do so would be unconstitutional under the 14th Amendment. They could also mint a trillion-dollar platinum coin that could be used to fund new spending, including debt service on the national debt. The problem with pursuing any of the above would be that it would almost guarantee that the Republicans in Congress would have no incentive to vote to raise the debt ceiling.

Democrats have learned some hard lessons by giving in to debt limit demands in the past. Back in 2011, during a clash between former President Obama and the Republican Tea Party, the administration spent months negotiating without success.

At the eleventh hour, an agreement was fashioned by Mitch McConnell and some Democrats to avoid a debt default. But the credit markets, spooked by the close call and partisan behavior, downgraded the country’s credit ranking for the first time, which resulted in raising the costs of our future borrowings.

The facts are that those who threaten default are part of the partisan political process, but some person, group, or party that causes a debt default will go down in flames along with the economy and nation. Politicians know this, or if they don’t there are still enough level heads in Washington to get the deal done.

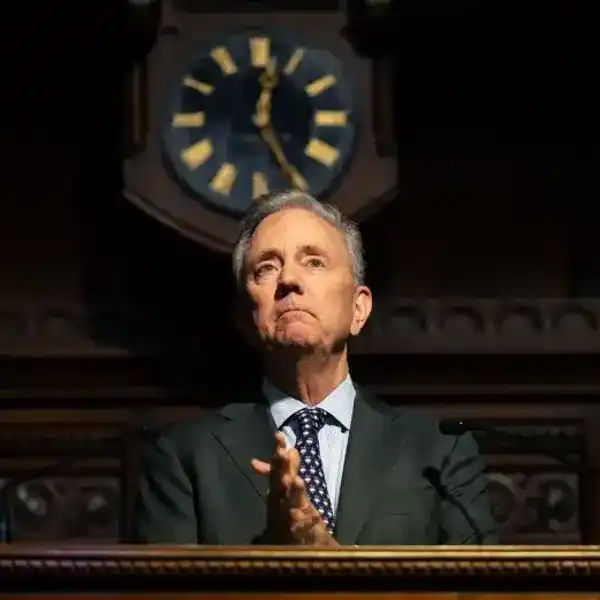

Bill Schmick is a founding partner of Onota Partners, Inc., in the Berkshires. None of his commentary is or should be considered investment advice. Email him at bill@schmicksretiredinvestor.com.

Pelenakeke Brown’s “Reverb” (detail) at Mass MoCA. D.H. Callahan

Pelenakeke Brown’s “Reverb” (detail) at Mass MoCA. D.H. Callahan

The debt ceiling drama